.webp)

The race is no longer just about models — it's about who controls the compute, the cloud, and the quantum lever.”

The rise of quantum computing is no longer confined to academic labs; it is reshaping national strategies and private investments worldwide. According to McKinsey, the global quantum technology market could exceed $100 billion by the early 2030s, driven by breakthroughs in quantum chips and their integration with Artificial Intelligence (AI) (McKinsey, 2025). Research by Grand View estimates the quantum AI market alone was valued at USD 341.8 million in 2024, and is projected to reach USD 2.01 billion by 2030, growing at 34.6% CAGR (Grand View Research, 2024). These numbers highlight why governments and firms are racing to secure leadership in quantum machine learning (QML) and AI IoT ecosystems.

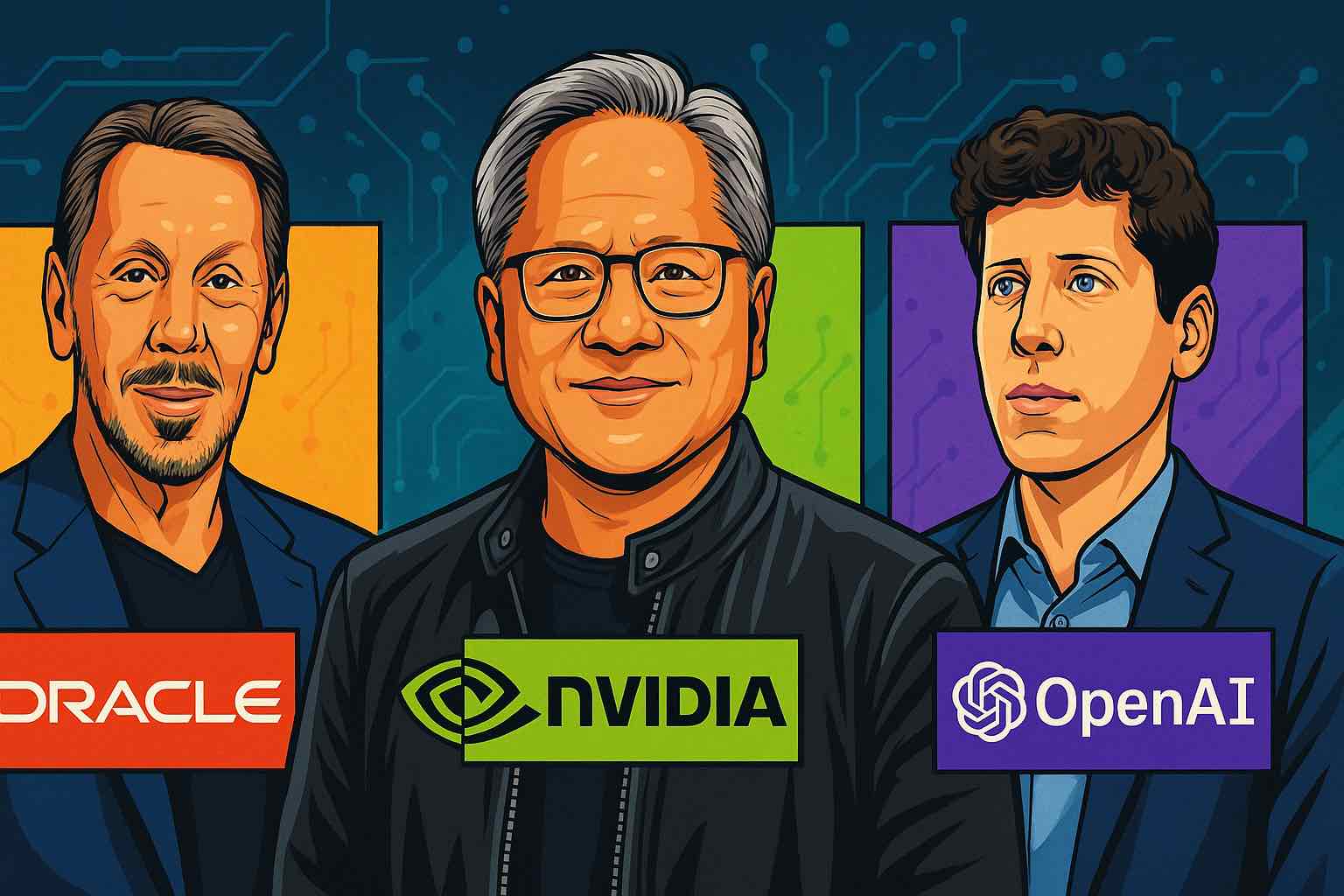

The most visible reshaping of markets comes from the partnership between OpenAI, Nvidia, and Oracle. In September 2025, Nvidia pledged up to $100 billion in financing to deploy 10 gigawatts of systems dedicated to OpenAI’s next-generation data centers (Reuters, 2025). This investment intertwines Nvidia’s dominance in GPU manufacturing with OpenAI’s leadership in AI model development. At the same time, Oracle secured contracts to host this infrastructure through its expanding cloud services, underpinning OpenAI’s ambitious “Stargate” supercomputing project (Yahoo Finance, 2025).

Analysts warn this triangular relationship could create structural dependency in compute markets. As BBC notes, the consolidation of AI power among a handful of players poses questions about competition and sovereignty (BBC, 2025).

Financial institutions have long pushed computational boundaries, and quantum AI promises to accelerate tasks like derivatives pricing and risk modeling. A study published on arXiv demonstrates that hybrid QML methods, combining quantum Gramian Angular Fields with CNNs, reduced forecast error rates by up to 48% in time-series prediction (arXiv, 2023). With Nvidia hardware powering OpenAI’s infrastructure, banks relying on advanced AI systems could become indirectly tied to this ecosystem.

The global quantum AI credit scoring market is forecast to grow at nearly 30% CAGR between 2024 and 2030, reaching billions in value, according to DataIntelo (DataIntelo, 2024). This highlights why financial regulators are paying attention to concentration risks posed by Nvidia–OpenAI partnerships.

Industrial automation is being reshaped by the integration of AI IoT, where smart sensors feed into real-time analytics. A ScienceDirect study notes that quantum optimization applied to manufacturing layouts and logistics significantly improves efficiency in large systems (ScienceDirect, 2024).

Nvidia’s expansion into edge devices, combined with Oracle’s global cloud footprint, means QML solutions for predictive maintenance and robotics can be scaled more rapidly. This is critical for nations like Germany and Japan, where Industry 4.0 strategies hinge on compute-intensive industrial control.

Drug discovery and precision medicine are prime use cases for quantum machine learning (QML). Nature Biotechnology reports that QML has already improved protein-folding simulations, shortening discovery timelines by up to 50% (Nature Biotechnology, 2024). This has profound implications for healthcare, where AI is being applied to genomics, imaging, and diagnostics.

Oracle’s positioning as a cloud provider for OpenAI offers an indirect entry into medical research platforms. However, reliance on U.S.-centric infrastructure raises sovereignty concerns for the EU, where regulations such as GDPR prioritize patient data sovereignty (European Commission, 2025).

Energy markets are another sector poised for disruption. IEEE research suggests that quantum-accelerated algorithms could optimize electricity grid dispatch, reducing costs by up to 20% in pilot tests (IEEE Xplore, 2025). With climate targets tightening, energy companies in Europe and North America are exploring QML-based optimization of renewable integration.

Logistics and supply chain giants, from DHL to Maersk, are piloting AI IoT systems for fleet optimization. By embedding quantum solvers into routing software, delays could be cut by 15–30%, according to a World Economic Forum report (WEF, 2024).

Telecom firms are integrating AI IoT to manage 5G/6G network slicing and anomaly detection. Ericsson research notes that combining edge AI with quantum-safe cryptography may define the security architecture of smart cities (Ericsson, 2025).

OpenAI’s alignment with Oracle’s global cloud backbone makes it a likely partner for smart city deployments in Asia and the Middle East. However, Futuriom has raised antitrust concerns, suggesting such consolidation could reduce competition in telecom-AI integration (Futuriom, 2025).

The U.S. remains the global leader, with the National Quantum Initiative and DARPA programs funding quantum-AI projects. According to AP News, Nvidia’s $100 billion OpenAI bet dwarfs most national programs in size (AP, 2025).

In Europe, the EU Quantum Flagship invests over €1 billion into research, but analysts at Investopedia argue that capital intensity lags far behind the U.S. and China (Investopedia, 2025).

China, through state-backed programs, continues to pour billions into quantum computing and AI. Reports from the South China Morning Post highlight China’s focus on integrating quantum into national defense and industrial strategies (SCMP, 2025).

Emerging players such as Singapore, Japan, and Canada are building specialized ecosystems. For instance, D-Wave in Canada is pioneering hybrid quantum-AI toolkits, according to Barron’s (Barron’s, 2025).

Beyond the giants, startups like IonQ are positioning themselves as the “Nvidia of quantum AI.” Yahoo Finance notes investor enthusiasm for IonQ’s roadmap in trapped-ion systems (Yahoo Finance, 2025).

Meanwhile, CoreWeave has expanded its partnership with OpenAI under a $6.5 billion contract, showing how second-tier players benefit from the consolidation (Reuters, 2025).

Yet risks remain. Futuriom warns that Nvidia’s dual role as both supplier and investor in OpenAI could attract regulatory scrutiny (Futuriom, 2025). Technical hurdles like error correction and coherence times also mean timelines could slip, as emphasized in Nature Reviews Physics (Nature Reviews Physics, 2024).

The strategic convergence of OpenAI, Nvidia, and Oracle represents more than a partnership; it is a reordering of global compute power. With markets for quantum AI, ai iot, and QML expected to grow at ~30–35% CAGR this decade, those controlling compute infrastructure will shape not only markets but also geopolitical advantage (Precedence Research, 2025).

For policymakers and educators, the challenge is to foster open ecosystems, quantum-safe security, and ethical adoption. For industry leaders, the question is not whether to embrace quantum-AI integration, but how quickly — and through which partners.

From breaking news to thought-provoking opinion pieces, our newsletter keeps you informed and engaged with what matters most. Subscribe today and join our community of readers staying ahead of the curve.

.webp)

.webp)